A consumer loan is a type of financing that can help you make purchases that you can’t afford to pay in cash. Whether you’re buying a car, paying for medical bills or putting together a home improvement project, this type of funding can be a lifesaver.

These loans can be repaid over a certain period of time and come in both closed-end and open-end options. We recommend that for further information read Finanza’s bloggpost om søk forbrukslån and translate into English.

It can help you buy a car

Getting a consumer loan is one of the easiest ways to buy a car. There are many different types of loans available from banks, credit unions and online lenders.

Depending on the lender, the loan may be for the entire cost of the car or only a portion of it. They can be repaid over a period of time, with a monthly payment set up with the lender.

There are also unsecured consumer loans, which are not backed by collateral and come with higher interest rates than secured ones. These are typically used for major purchases and for consolidating high-interest credit card balances.

These loans can be a good option for people who need to buy a new car but can’t afford to pay for it upfront. They’re generally less expensive than other types of financing, and you’ll be able to see how much you’ll be paying for the car upfront when you get pre-approved.

It can help you pay for medical bills

A consumer loan can be a great way to pay for medical expenses, such as emergency procedures or elective surgery. It can also help you refinance existing debt.

However, it’s important to make sure you use the money wisely. You don’t want to end up with a credit card debt spiral that ends up damaging your credit score.

To avoid this, talk to your health care provider before you put your bills on a credit card. If you’re able to demonstrate financial hardship, your provider may be willing to lower the balance or reduce interest rates to help you keep your payments affordable.

A personal loan can be a helpful option for paying medical expenses, but be sure to compare the terms and APRs before you sign a contract. Lenders will evaluate factors, including your credit history and income, to determine if you qualify for a loan.

It can help you pay off credit cards

A consumer loan can help you with a number of purchases, including paying off credit cards. It can also be used to purchase a car or home, and it can provide an additional source of income when needed.

One popular way to pay off debt is to use a personal loan to consolidate all of your credit card payments into a single, lower-interest rate payment. This strategy can save you money in interest over time, but it’s not right for everyone, and there are alternatives that may be better for your financial situation.

Some personal finance gurus recommend targeting smaller credit card balances first, as this is thought to be the fastest and cheapest way to pay off all your debt. But it’s only the best strategy if you stick with it.

If you take out a personal loan to pay off your credit cards, you should avoid using them while you’re repaying it. This will keep you from racking up more debt on those cards and making it even harder for yourself to become debt-free in the future.

It can help you buy a home

Whether you’re buying your dream home, upgrading to a new car or you need some extra cash to take care of unexpected expenses, a consumer loan can be the key to unlocking your financial future. There are many different types of consumer loans, each with their own strengths and weaknesses. For example, a home equity line of credit (HELOC) can be a great way to consolidate debts without negatively impacting your credit score.

In the consumer finance world, the best consumer loans are those that fit your unique needs and lifestyle. The best ones are those that offer features that make them easy to manage and repay. Some of these features include low monthly payments, no closing costs, low fees and a variety of flexible payment options to suit your needs. The most important thing to remember is that you should never borrow more than you can afford to pay back over the life of the loan.

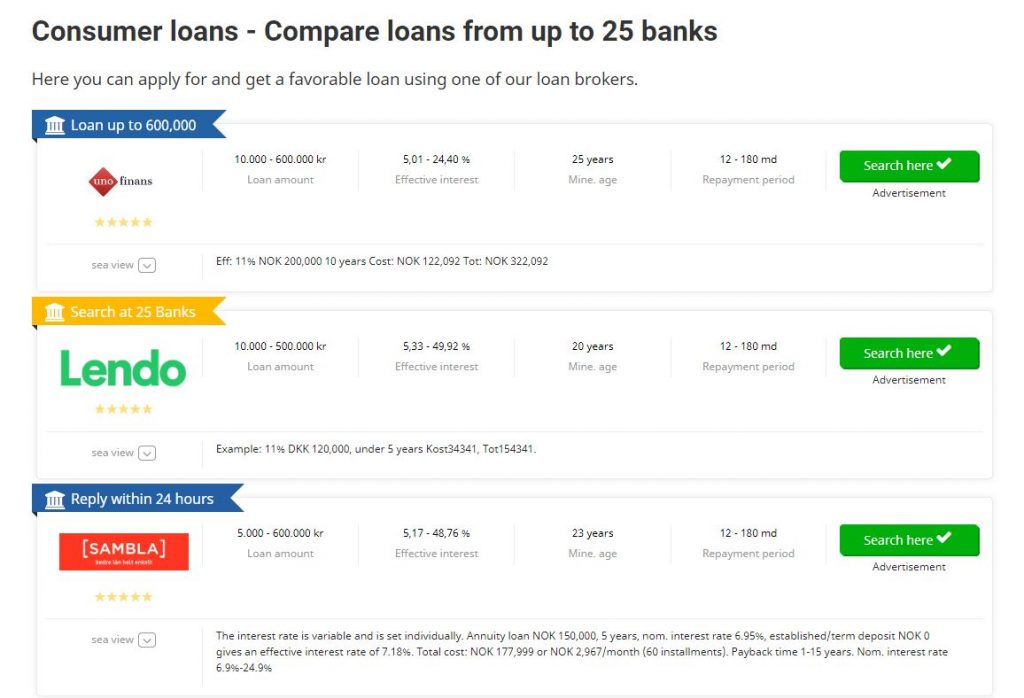

How Brokers Can Help You Get a Consumer Loan

Consumer loans are financial products that help people buy things they would otherwise not be able to afford. They are often used as a means of financing big purchases, such as buying a car or paying for education, and can be an essential part of a consumer’s financial life.

Loans are available from banks, credit card companies and private lenders, and can be unsecured or secured. Unsecured loans are usually lower-cost than secured ones.

How to Get a Loan

A consumer loan is any type of debt financed by a creditor, such as a bank or credit card company. A loan can be a fixed amount that is paid back over a certain period of time or it can be a revolving account that allows the borrower to withdraw funds and pay interest on them as they need to.

Whether you need to borrow money depends on a variety of factors, including the size of your income and your existing assets. Mortgages, auto loans and student loans are popular types of consumer loans.

Personal loans, on the other hand, are a form of consumer lending that can be used to fund a range of large or small expenses, such as traveling abroad, completing an education, purchasing an appliance or renovations in the home. These types of consumer loans are a great way to finance many life experiences, but it is important to be careful with them, as they can easily wreak havoc on your finances and credit rating.

How to Find a Loan Broker

A credit broker helps people find a lender that can provide them with a specific type of loan and then negotiates on their behalf for the best terms and conditions. They can save you time by negotiating with multiple lenders for you and by providing a single point of contact throughout the process.

However, it is worth remembering that brokers often charge fees in addition to the lender’s fees. These can be in the form of “points” you pay at closing or as an add-on to your interest rate, and they are not always transparent. Ask each broker how they are compensated before you start working with them.

How to Identify a Scam or Fraudulent Credit Broker

A fraudulent credit broker may offer to find you the best rates on payday loans, but then pressure you into applying for more money than you need and trying to talk you into monthly payments that you can’t afford. They may also tell you to falsify information on your loan application or misrepresent the kind of credit you’re getting.

You can check if a broker is a scam by asking for proof that they are licensed in your state and by reading their business license and registration documents. They must also post a $25,000 surety bond.

If a credit broker is not licensed in your state, it is illegal to use their services in that state. You can file a complaint with the Bureau of Consumer Credit Protection.